Tata AIA Life shall have the proper to assert, deduct, modify, Get well the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable beneath the Plan. Kindly refer the revenue illustration for the precise premium.

The efficiency with the managed portfolios and cash is not guaranteed, and the value could enhance or lessen in accordance with the longer term encounter on the managed portfolios and cash.

The fund maintains flexibility to speculate in meticulously selected companies that offer alternatives across large, mid or compact capitalization Room

Please know the associated threats as well as relevant expenses, from your insurance agent or maybe the Intermediary or plan document issued from the Insurance provider.

*Cash flow Tax Rewards could be available as per the prevailing income tax legislation, matter to fulfilment of conditions stipulated therein. Profits Tax legal guidelines are subject to alter every now and then.

The Wellness$$ Software relies on factors you can gain by finishing on the web wellbeing assessments and by Assembly day-to-day and weekly physical activity objectives.

You will discover 4 different degrees beneath the Wellness Program, and you can move from one particular degree to another, foundation the factors you have got attained by way of your targets and also your assessments.

Tata AIA Vitality$$ is often a globally acknowledged, holistic and science-dependent wellness program that helps you recognize and help your health whilst also gratifying you. The rewards may very well be in the shape of Discount on Premium, Include Booster and so on.

Tata AIA look at here now Lifetime Insurance provider Ltd. would not believe duty on tax implications talked about anyplace on This great site. Make sure you consult your possess tax consultant to know the tax Added benefits available to you.

The target of the Fund would be to make funds appreciation in the long run by buying a diversified portfolio of companies which might get pleasure from India’s Domestic Use advancement Tale.

In ULIP, a percentage of the high quality paid by the policyholder is employed for lifestyle insurance policies coverage, though the remaining volume is invested in numerous fairness, debt or click to investigate well balanced resources as per the policyholder's choice.

Avail tax Gains According to relevant tax guidelines Adaptability to choose from a number of major rated++ fund options ranging from fairness to personal debt-oriented Cost-effective Premiums

Even though every treatment continues to be taken in the planning of the content, it really is subject matter to correction and markets may not execute in the same style depending on things influencing the cash and credit card debt marketplaces; consequently this ad does not separately confer any lawful rights or responsibilities.

This is simply not an investment tips, be sure to make your own private impartial final decision immediately after consulting your money or other Specialist advisor.

ULIPs present the flexibleness of choosing concerning distinctive resources dependant on the policyholder's threat hunger and share marketplace investment objectives. The policyholder can swap among different resources According to their economical goals and sector situations.

The Term Booster6 is an additional attribute that improves the protection of your respective plan. If the lifetime insured is diagnosed that has a terminal sickness, they are going to get ten% on the sum assured underneath the daily life insurance plan coverage.

ULIP means Device Connected Insurance Prepare, which is a sort of insurance plan product that mixes some great benefits of page existence insurance policy and investment in one approach.

The maturity reward presented below this plan is the entire fund price of your investment at 4% or eight%, as maturity7 sum such as loyalty additions along with other refundable rates, together with the return of all of the premiums paid out to the Tata AIA Vitality Safeguard Advance daily life insurance coverage plan.

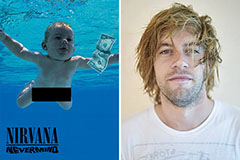

Spencer Elden Then & Now!

Spencer Elden Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!